Egypt must face reality and reform to build on its success stories - By : Dr.ZIAD BAHAA-ELDIN

Egypt must face reality and reform to build on its success stories- By : Dr.ZIAD BAHAA-ELDIN

The need is to transform the minority of successful Egyptian companies into an overwhelming majorityZIAD BAHAA ELDIN

In October of last year, it looked like Egypt was embarkingon an economic reform programme to bring north Africa’s largest economy out of a growing crisis that had started in early 2022.

This included a new agreement with the IMF, the devaluation of the Egyptian pound by 50 per cent, announcing a new policy to reduce the role of the state in the economy, and earmarking 32 state-owned companies for divestiture. These measures were met with some — albeit not overwhelming — enthusiasm that Egypt was finally taking the bold steps needed to embark on a growth trajectory.

But, several months later, local and foreign investors alike, as well as rating agencies and international financial institutions, had become increasingly sceptical that the promised reforms would ever materialise — and the key economic indicators remained far from reassuring.

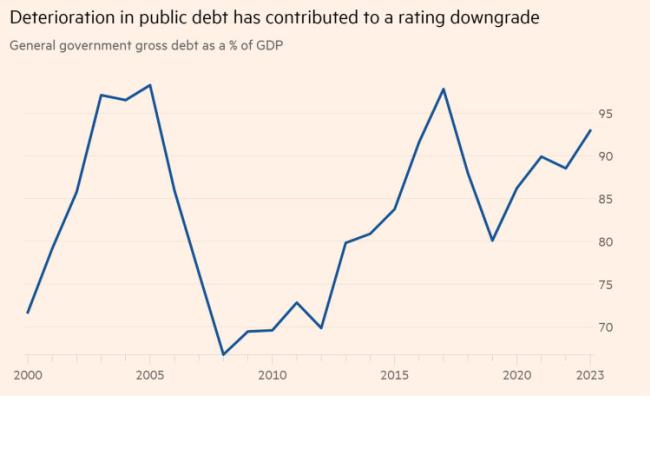

Thus, early this month, Egypt was downgraded by Fitch Ratings — for the first time in a decade — on the basis of what the rating agency deemed to be a lack of significant reforms. It also cited the country’s high external financing requirements, combined with constraints on obtaining future funding, as well as the deterioration of public debt “metrics”.

So, why have the reform efforts not materialised, nor brought about the anticipated recovery?

For one thing, the denial factor continues to hamper progress. In a statement issued by the Egyptian government to rebut Fitch’s pessimism, the economic crisis was mostly attributed to the Covid pandemic and, additionally, to Russia’s war on Ukraine.

This is no longer accepted by most independent analysts and observers. They worry about denying the additional, and significant, impact of other self-inflicted causes of the crisis: the excessive spending on long-term infrastructure projects; the lack of prudence in borrowing locally and internationally; the unprecedented growth of the state’s role in the economy; and the highly bureaucratic environment facing private sector investors.

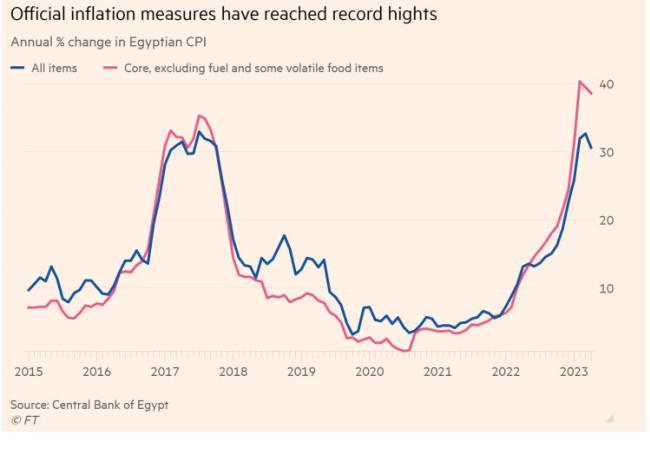

This is not a debate about the past but about the future. Recognising previous policy mistakes is a necessary precondition for embarking on an all-out reform path and turning around an economy that has seen official inflation reaching 40 per cent, the currency black market thriving, import constraints harming productive capacities, and Egypt’s debt burden reach new and alarming heights.

Add to this the lukewarm support by Gulf countries — traditionally seen as a donor of last resort — and achieving genuine economic reform becomes a matter of utmost priority.

But, while the economy at large, as well as the mainstream of private sector companies, have been suffering, some Egyptian enterprises — old and new, small and large — have found opportunities. Many have managed to transform themselves and adapt to a new normal.

Export is the name of the game. Scores of agricultural producers, herbal and horticulture businesses, manufacturers of building materials, garments and light manufactured goods, as well as providers of technological solutions, have managed to find their way to growing markets in the region and beyond.

The common features among companies in this successful club — albeit one of still limited membership — are, however, indicative of the hardship of the current economic crisis. These features include: relying mostly on local inputs and thus avoiding import constraints; avoiding competition by state companies; limiting the growth of overheads; and, largely, keeping a low profile and steering clear of the limelight.

Looking ahead, professional service companies, technology providers, consultants, data processors and others, meanwhile, are aiming to increase their returns by providing back office services to neighbouring economies — and, therefore, benefiting from the opportunities created by the currency devaluation.

But this is not enough. To grow and overcome the present economic hardship, Egypt needs to transform this minority of successful businesses into an overwhelming majority.

On May 16, the government announced a comprehensive package of investment-friendly measures, aimed at boosting private sector investment by reducing bureaucratic hurdles, providing some assurance of fair competition with the state and giving clarity on taxation.

These are much welcomed measures — perhaps more for the positive signal they send than for their substance and content. To turn around the economy will require much more than facilitating the issuance of permits or providing some tax relief.

For the message to be truly convincing, and to attract the attention of a sceptical community of international and local investors — as well as rating agencies — a comprehensive economic reform programme must be adopted, declared and followed through.

Only then will success stories become the norm and will Egypt’s abundant opportunities and potentials be realised.

The writer is an economist, commercial lawyer and former deputy prime minister of Egypt 2013-14

Financial Times

https://www.ft.com/content/b5bec0d9-7aac-4182-b908-06f35176097a